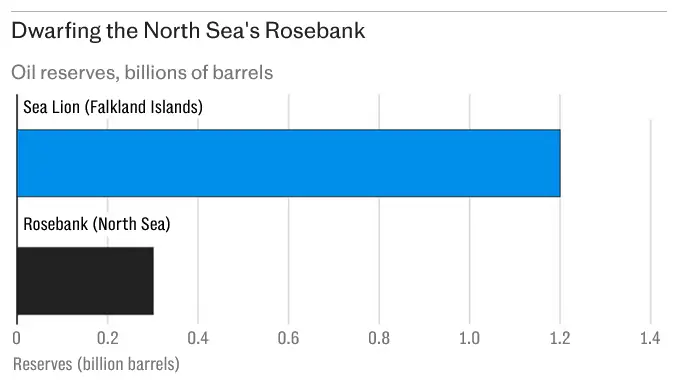

Sea Lion field is thought to hold 1.7 billion barrels – several times larger than the UK’s Rosebank

The Falkland Islands is poised to open its first major oil field using a North Sea drilling ship, with hopes of unlocking a windfall equivalent to £1m per islander.

Navitas, the lead operator of the Falklands field, has told investors it has signed contracts to move the Aoka Mizu floating production vessel from

Shetland to the Falklands and plans a formal “final investment decision” this month.

In a note to investors, the company said it had now won approval “in principle” from the Falkland Islands government and was working to get final approval for its plans. Once deployed, the Aoka Mizu will drill up to 23 wells in the first stages of the development.

The Falkland government said it was keen for drilling to get under way. A spokesman said extracting the oil was “a political and community priority for the Falkland Islands”.

They added: “If a hydrocarbons industry is successfully established, it will provide transformative opportunities for the people of the Falkland Islands, leading to financial and political security.”

Estimates suggest the extractable oil in Falkland waters is worth at least $1.3bn, equivalent to around £1m for each of the 4,000 islanders. The exact share of revenues between private developers and the local government is not yet clear.

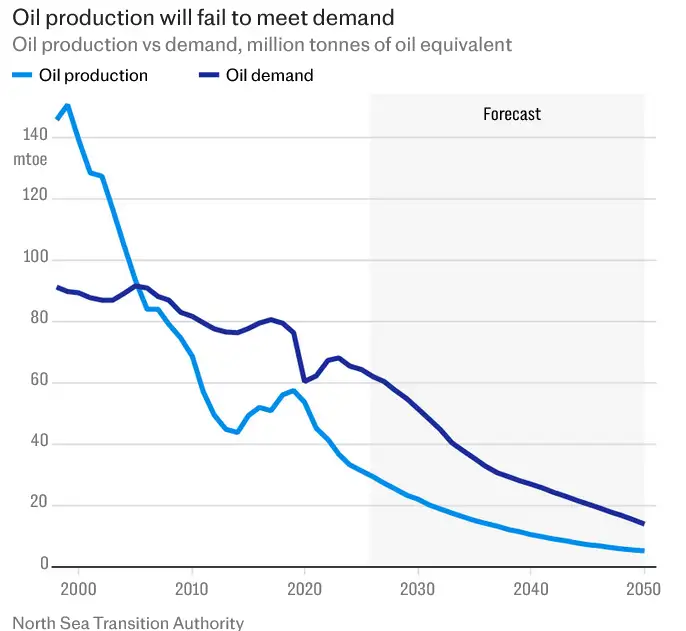

Moves to exploit the natural resources come even as Ed Miliband, Britain’s energy secretary, bans exploration in UK waters.

Britain has controlled the Falklands since 1833, apart from a brief spell in 1982 when they were invaded by Argentina and then taken back by the UK. Inhabitants are British citizens and the UK has responsibility for their defence and foreign affairs.

However, the islands are a British overseas territory that governs itself and, as a result, Mr Miliband’s ban on drilling does not extend to the Falklands.

A spokesman for the UK Foreign Office said: “We have been clear that any decision on this issue is a matter for the Falkland Islands government and the private companies concerned.”

The Aoka Mizu’s departure from the North Sea is part of a wider trend that has seen other drilling rigs and production vessels leave the UK for Norwegian waters, or head to regions like the Middle East as Britain winds down its offshore oil and gas industry. The vessel in question has worked in the British North Sea for almost two decades.

The Sea Lion field that the Falklands is preparing to exploit is thought to contain up to 1.7bn barrels of oil – larger than anything remaining in UK waters.

It was originally discovered by Rockhopper Exploration, a UK company. Its latest financial report states that Rockhopper’s share of the oil in Sea Lion has been valued at $1.3bn based on an oil price of $60 a barrel.

The costs of the scheme prompted Rockhopper to go into partnership with Navitas, an Israeli company, which now holds two-thirds of the working interest in the project. Navitas has also raised $378m for the first phase of development.

Both Rockhopper and Navitas said they could not offer further comment pending the formal final investment decision.

Hugo Heerema, chief executive of Bluewater, the Dutch offshore operator that owns the Aoka Mizu, said the ship had been producing oil in the UK’s North Sea since 2009. It worked first on the Ettrick field off Aberdeen and then on the Lancaster Field off Shetland.

Mr Heerema said: “The vessel is slated for Navitas’ Sea Lion development[…] Depending on Navitas go-ahead, it may leave the Lancaster site in mid-2026.”

Sea Lion lies under about 500 metres of water and another 2,000 metres of rock, making it relatively easy to access using modern drilling techniques.

The Falklands lie in the South Atlantic off Argentina, made up of two large islands – East Falkland and West Falkland – plus nearly 800 smaller islands.

“When you share your news through OGV, you’re not just getting coverage – you’re getting endorsed by the energy sector’s most trusted voice.”