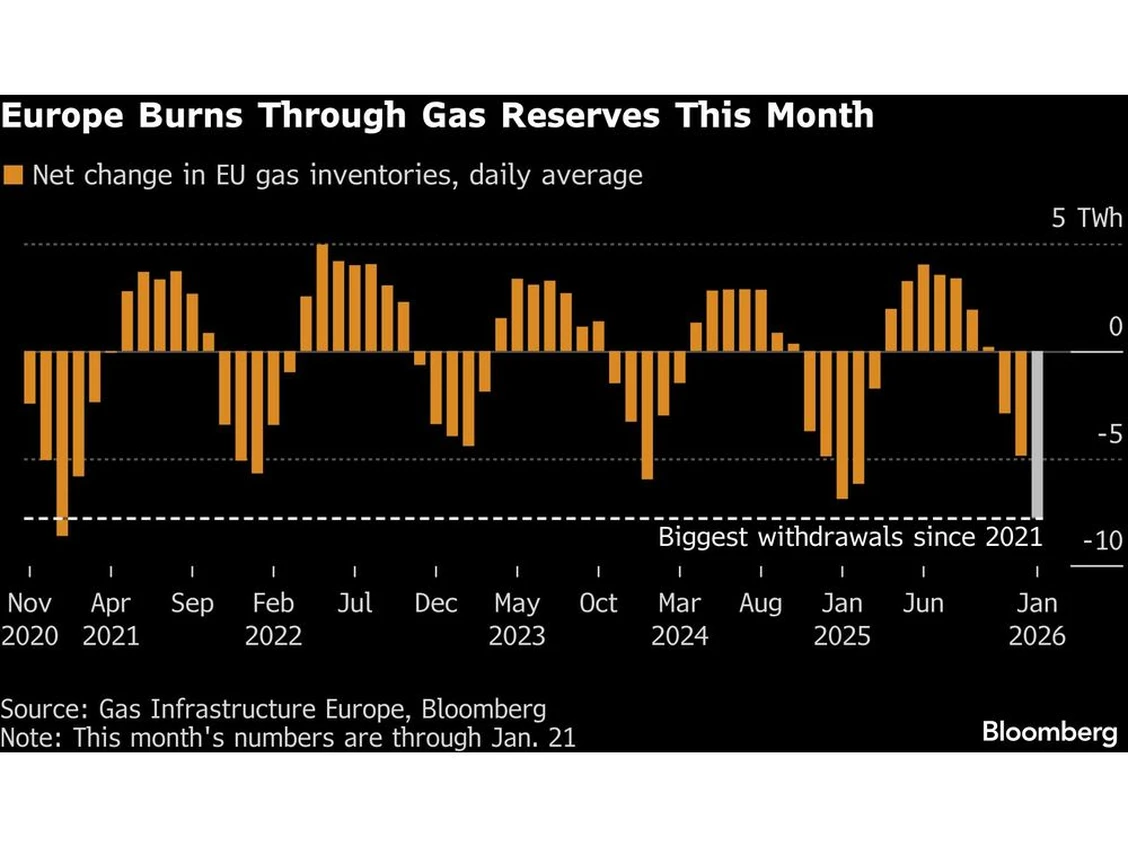

Europe is leaning more heavily on gas reserves this winter, with this month’s withdrawals running at the fastest pace in five years amid unusually cold weather.

Pipeline and LNG flows haven’t been able to meet higher energy needs, causing net withdrawals to average around 7.79 terawatt-hours, or roughly 730 million cubic meters, per day. LNG imports have been at less than half of those levels.

Gas prices have surged more than 30% so far this month, after cold weather upended market sentiment and triggered a sharp reversal in bearish positioning. Stockpiles are now less than half full, far emptier than they usually are at this time of year, and Wood Mackenzie Ltd. sees them ending winter at 20%. On top of that, an unfavorable price spread between summer and winter contracts has weakened the economics of stockpiling — a repeat of the situation that led to the storage deficit.

“Europe has a tighter balance than in previous winters,” said David Lewis, a senior research analyst at the firm. “As a result, storage is having to compensate for weaker pipeline supply and higher demand.”

Article content

While Europe already lost most of its former Russian pipeline flows after Moscow’s invasion of Ukraine in 2022, some of the remaining deliveries were curbed again at the start of 2025 when a transit agreement with Kyiv expired. As a result, the region has had to rely even more on LNG in the run-up to this winter.

Article content

Withdrawals from storage sites aren’t only driven by cold weather, according to Bloomberg Intelligence’s senior analyst Patricio Alvarez. They also reflect the economics of using stored gas versus importing flexible LNG.

LNG imports are less attractive when spot prices are high — as they currently are — because the fuel is priced at those elevated market levels and includes shipping and regasification costs. Meanwhile, gas in storage was bought earlier at lower prices and can be withdrawn quickly and at lower marginal cost.

Article content

Even so, January’s drawdowns have been elevated compared to historic levels, Alvarez said. The situation has sharpened the focus on potential policy responses ahead of the next stockpiling season, which typically begins in April.

Article content

According to Wood Mackenzie’s Lewis, new LNG supply coming online in the spring should help Europe fill storages at the fastest pace in five years. Other analysts are less certain that this will happen without state support.

Article content

“Government intervention cannot be ruled out,” said Davide Tasinato, an analyst at Axpo Italia. “Subsidies tied to storage targets could support injections ahead of the refill season,” though any decisions would likely only be disclosed at the last moment to prevent speculation.

“From our platform to LinkedIn’s energy professionals – your announcements reach the entire sector’s network, not just our readers.”