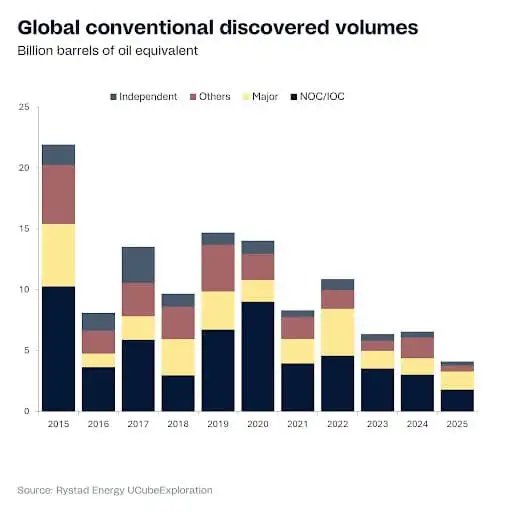

- Annual conventional discoveries have fallen from over 20 billion boe in the early 2010s to about 8 billion boe since 2020.

- This results in an effective replacement rate of well under one-third of yearly production.

- New barrels are increasingly concentrated in high-impact frontiers like Guyana, Suriname, Brazil’s pre-salt, and Namibia’s Orange Basin.

The world’s oil production is running flat out, with consumption far outstripping new discoveries. According to Norwegian energy consultancy Rystad Energy, annual conventional discovered volumes averaged more than 20 billion barrels of oil equivalent (boe) per year in the early 2010s; however, they have averaged to slightly over 8 billion boe per year since 2020.

Indeed, global oil discoveries have fallen sharply over the past decade. According to Rystad Energy, annual conventional discovered volumes averaged more than 20 billion barrels of oil equivalent per year in the early 2010s, but have declined to just over 8 billion boe annually since 2020, despite standout frontier finds in Guyana, Suriname, and Namibia. Rystad further notes that the average drops to roughly 5.5 billion boe when looking at discoveries between 2023 and late 2024, highlighting how subdued exploration success has become even as global oil consumption remains near record levels.

In a separate analysis, Rystad has shown that recent conventional discoveries have replaced well under one-third of annual oil production on a sustained basis, underscoring a widening gap that increasingly must be filled through unconventional resources, enhanced recovery from mature fields, or higher long-term investment levels.

Capital expenditure on exploration was severely slashed after the mid-2010s, dropping to around $50 billion to $60 billion in 2025, significantly down from the $115 billion peak in 2013. This is a mere fraction of the $500–540 billion annual budget required to prevent supply shortages and meet future demand.

According to Rystad, the decline can also be chalked up to a strategic change wherein the global exploration map of E&P companies is no longer defined by sheer acreage, with companies employing strategic precision. National oil companies (NOC) and supermajors alike are increasingly focusing on high-impact basins, including Suriname’s deepwater basin, Namibia’s Orange Basin, and Brazil’s pre-salt basin, as well as infrastructurally rich near-field explorations, while divesting from mature and low-return regions. These modern exploration campaigns focus on nearby, lower-cost tiebacks, better subsurface data, existing infrastructure, and digital tools to manage risk and improve returns.

This concentration of discoveries in a handful of countries or specific hotspots–Namibia, Guyana, Brazil and Suriname, among others–highlights the narrowing geography of exploration success and the risk-taking appetite of global E&P companies. Frontier nations see this as an opportunity to lure and attract foreign investment via friendly fiscal terms to help generate revenues and build energy security, while continued appraisal of under-explored plays, such as ultra-deepwater or the untapped stratigraphic traps, offers mature-producing nations optionality for long-term growth and a way of arresting declines in production.

The 2006 discovery of the Tupi field (now Lula) by Petrobras and its partners in the Santos Basin, Brazil, revolutionized the oil industry by unlocking massive pre-salt reserves. Located under nearly 2,000 meters of water and an additional 2,000 meters of salt, this “elephant” find required advanced seismic technology to image beneath the salt, proving that previously deemed “impenetrable” geological layers could be accessed. The field holds estimated recoverable resources of 5-8 billion barrels of oil equivalent. The reserves are located ~7,000 meters below the ocean surface, requiring innovative, specialized drilling techniques to navigate the salt layer. The discovery was a “calculated gamble” that relied heavily on PROCAP (Petrobras Technological Capacitation Program in Deep Waters) for developing techniques for extreme depths. Extensive 3D seismic programs were used to image the subsurface through more than 2,000 meters of salt, providing the detailed geological insights necessary to map the pre-salt structure. 3D geocellular modeling & visualization was used to analyze the structure and define the potential reservoir, helping to identify the “outer high” feature in the Santos Basin where Tupi was located. Nuclear magnetic resonance (NMR) Logging was employed to accurately measure porosity and differentiate between oil and water, particularly in complex carbonate rocks.

The second frontier emerged in Guyana and Suriname, where ExxonMobil made the Liza-1 discovery in 2015, which encountered more than 295 feet (90 meters) of high-quality, oil-bearing sandstone reservoirs in 5,719 feet (1,743 meters) of water. Prior to this, the region was considered a frontier with a history of over 40 dry holes in the basin, making the 2015 find a dramatic, game-changing “wildcat” success. Exxon employed advanced, proprietary, and high-resolution imaging technologies designed to map complex subsurface geological structures deep below the seafloor. Full Wavefield Inversion (FWI), a high-resolution seismic imaging technique used to analyze seismic data, helped geoscientists to “see” and differentiate rock properties with high precision to identify reservoirs. High-performance computing was used to process large, complex datasets, allowing for faster and more accurate decision-making in the exploration phase.

The third and most recent frontier has been unfolding in Namibia’s Orange Basin, where Shell, TotalEnergies and Galp Energia have opened one of the most promising new petroleum provinces in recent years. 3D seismic acquisition and processing were critical for imaging deep subsurface structures and identifying potential traps. Major, high-capacity, semi-submersible rigs and drillships–such as the Deepsea Bollsta, Deepsea Mira, and Noble Venturer–were employed to drill into the deepwater, high-pressure, and high-temperature environments. Advanced geochemical techniques, such as gas chromatography-mass spectrometry (GC-MS) and quantitative diamondoid analysis (QDA), were used to analyze the source rock and oil composition. Meanwhile, intense wireline logging, including sidewall coring and drill stem testing, was crucial to confirm the reservoir’s porosity, permeability, and fluid properties (e.g., 37° API oil).

“When you share your news through OGV, you’re not just getting coverage – you’re getting endorsed by the energy sector’s most trusted voice.”