Staff at industrial services company Bilfinger UK are planning to strike in the coming weeks over a pension dispute, triggering “widespread disruption” to 19 North Sea oil and gas projects, according to trade union Unite.

In a press release Dec. 2, Unite said over 400 offshore workers have “supported taking strike action in an escalating dispute over pensions.”

The workers are demanding they be moved to a gross earnings pension scheme, rather than the current capped employer contribution, the union said. It has to do with the weekly pattern of pay for Bilfinger offshore workers.

“Unite members are losing out on thousands of pounds every year in company pension contributions compared with other workers, which is completely unacceptable,” said Unite general secretary Sharon Graham. “We will back our Bilfinger members every step of the way in their fight to secure a just and fair pension settlement.”

The action — which is due to take place in the “coming weeks” if Bilfinger does not meet the workers’ demands — will hit oil producers BP, Canadian Natural Resources, Ineos, Ithaca and TAQA, Unite said, affecting 19 projects in total.

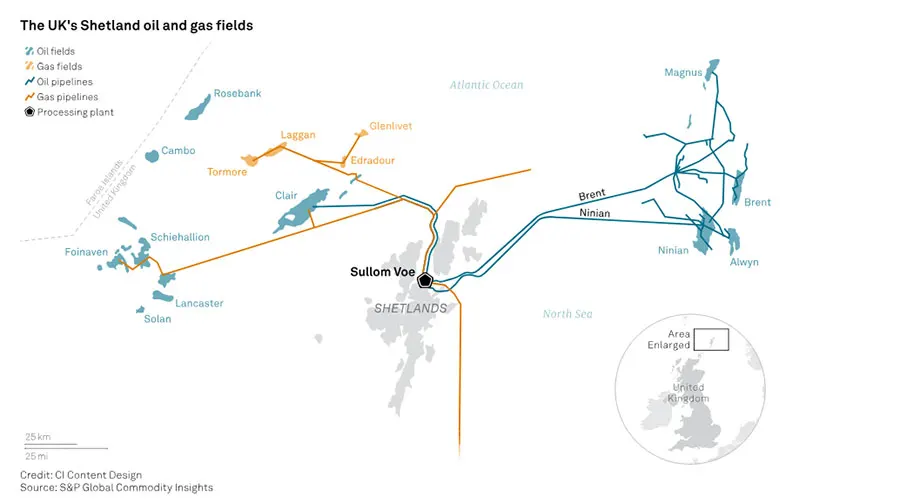

Among the fields impacted are BP-led Clair, the largest oil field in the UK Continental Shelf with an estimated 8 billion barrels of oil in place.

The project has a nameplate maximum production capacity of 120,000 b/d, but has produced at roughly half of that in recent years.

It would could also disrupt Ithaca’s Captain oil and gas field, which feeds gas to the UK. The company has been raising net production at Captain towards 30,000 b/d of equivalent in 2026 with its phase two project.

“Dozens of offshore installations will now be hit by widespread disruption due to workers being treated in an unacceptable and unfair way,” Graham added. “The blame for that strike action lies squarely at the door of Bilfinger HQ.”

Bilfinger did not respond to a request for comment from Platts on the strike action.

Representatives for BP and Ithaca did not immediately comment.

The strike action comes at a time of falling oil and gas output in the UK North Sea, driven by the country’s uncompetitive tax regime and slow project approvals, according to industry players.

“Join the companies that smart energy professionals follow – because when you’re featured on OGV, the industry pays attention.”