Offshore firm Ithaca Energy sees profits plummet as windfall tax bites

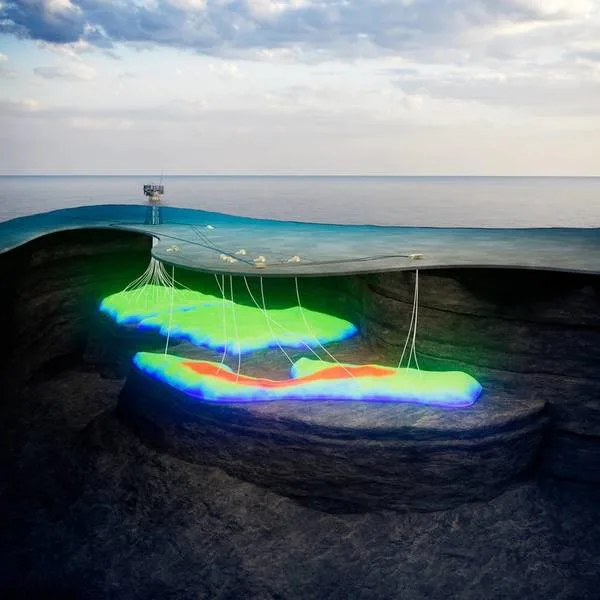

The North Sea oil and gas firm has reported a fall in profits and revenue for the six months to June 30, hit by impairment charges, lower production and a slump in oil and gas prices.

Offshore firm Ithaca Energy has seen its revenue and profit plummet due to impairment charges, decreased production and a slump in oil and gas prices.

Having announced plans in the spring to acquire all of Italian rival Eni’s North Sea assets for £754m, Ithaca reduced its full-year production forecast from between 80,000 to 87,000 barrels of oil equivalent (boepd) to a range of 76,000 to 81,000.

The company also reported considerably lower production figures in the first half of the year, with production falling to 54,046 boepd in the six months to June from over 75,000 in the same period last year. Net income dropped from £121.9m to £89.7m.

Earnings before interest, tax, debt, amortisation and exploration – a financial performance indicator used by oil and gas companies – fell from £748.4m to £407.2m, writes Insider.

The company was compelled to record an impairment charge of £14.5m alongside the earnings, which were further impacted by the decrease in the natural gas price, which has fallen over 60% since 30 June 2023.

The company’s earnings have been negatively affected by the UK Government’s Energy Profits Levy, a windfall tax on North Sea oil and gas operations imposed on energy companies following the substantial profits reported in the wake of Russia’s invasion of Ukraine, as reported by City AM.

In a move to accelerate the UK’s shift from fossil fuels, the incoming Labour government has announced plans to increase the levy to an effective rate of 78% and eliminate the investment allowance that companies like Ithaca benefited from to stimulate further exploration and investment.

Ithaca Energy’s earnings report was released concurrently with Offshore Energies UK’s open letter cautioning against the new tax measures’ potential harm to employment, and described the levy as a “substantial headwind”.

The semi-annual financial results marked the first significant report since Ithaca acquired North Sea holdings from Eni, the Italian oil and gas business.

Regarding the acquisition, Ithaca commented: “With a proven track record for value- accretive MandA, the combination creates an enhanced platform for delivery of the group’s inorganic growth strategy in the North Sea and internationally.”

“Ithaca Energy is well positioned to play a pivotal role in further North Sea consolidation … and with access to Eni’s global credentials and the expertise and relationships of its shareholders, supports the ability to broaden the group’s MandA strategy internationally, establishing additional options for value creation.”

Published: 26-08-2024