By Tsvetana Paraskova

OPEC’s decision on near-term oil production levels and a new mechanism to assess quotas in the longer term, investment plans of the national oil companies of key Middle Eastern oil and gas producers, and strategic and joint venture agreements of the NOCs featured in the Middle East’s energy sector at the end of 2025.

OPEC Holds Output Levels, Launches New Quota Review

The eight producers of the OPEC+ group – Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman – reaffirmed at the end of November their previous decision from 2 November to pause production increases in January, February, and March 2026 due to seasonality. The first quarter of any year is typically the weakest for global oil demand.

The eight OPEC+ countries reiterated that the remaining 1.65 million barrels per day (bpd) of current cuts may be returned in part or in full, subject to evolving market conditions and in a gradual manner.

“The countries will continue to closely monitor and assess market conditions, and in their continuous efforts to support market stability, they reaffirmed the importance of adopting a cautious approach and retaining full flexibility to continue pausing or reverse the additional voluntary production adjustments, including the previously implemented voluntary adjustments of the 2.2 million barrels per day announced in November 2023,” OPEC said.

In another decision at the meeting at end-November, the producers mandated the OPEC Secretariat to develop a mechanism to assess participating countries’ maximum sustainable production capacity (MSC) to be used as reference for the 2027 production baselines for all OPEC+ producers.

OPEC+ and its leader, Saudi Arabia, argue that the new mechanism to assess how many barrels of oil any given producer can produce for a sustainable period of time is more transparent and fair for determining production levels from 2027 onwards.

The assessment of the maximum sustainable production capacity will be carried out between January and September 2026 for the 2027 baseline levels, and OPEC+ plans to have the MSC assessed each year afterwards.

A U.S.-based auditing firm will assess the MSC of 19 out of the 22 OPEC+ members. Sanctioned Russia and Venezuela will use a non-U.S. company, while Iran, also under hefty sanctions, will use as a baseline for 2027 the average of its production in August, September, and October 2026, as assessed by OPEC’s secondary sources.

“Now we have the most detailed, the most technical, transparent approach of how we can move forward in the future in managing the market and how to attend to production,” Saudi Energy Minister, Prince Abdulaziz bin Salman, said, commenting on the new mechanism to assess production capacity.

Qatar Says More LNG Investment Needed to Meet Soaring Demand

Qatar, the world’s second-biggest LNG exporter behind the United States, affirms its long-standing commitment to support all nations for their LNG needs, QatarEnergy’s president and CEO Saad Sherida Al-Kaabi said at the Doha Forum 2025 in December.

“We have announced that we are raising production from 77 million to 142 million tons per annum in-country. An additional 18 million tons will come from our Golden Pass terminal project in the United States. We are ready to support all nations for their LNG needs if it is commercially viable for both sides,” said Al-Kaabi, who is also Qatar’s Minister of State for Energy Affairs.

Qatar expects the first train of its LNG expansion project to come online by the third quarter of 2026.

Commenting on the LNG supply and demand balances, Al-Kaabi said “I have no worry at all about demand in the future. I have a worry about lack of investment for additional supply in the future, which will cause prices to spike.”

With global economic growth, a billion people still lacking access to electricity, and gas needed to power factories, “we need to invest in the future,” the Qatari official noted.

Global LNG production is about 400 million tons today, while the world will need about 600 to 700 million tons by 2035.

“That is an additional 200-300 million tons spearheaded by growth mostly in Asia, but also in the rest of the world, there is also something that we never counted on, whether in 2017 or even just a few years back, and that is artificial intelligence (AI),” Al-Kaabi said.

ADNOC Unveils $150-Billion Investment Plan

The board of directors of Abu Dhabi’s national oil company, ADNOC, has approved the five-year business plan and capital expenditure (capex) of US$150 billion (551 billion UAE dirhams) for 2026-2030 to maintain current operations and boost growth as it continues to help meet growing global energy demand.

The Board also welcomed ADNOC’s achievement in increasing the UAE’s conventional reserves base from 113 billion stock tank barrels (stb) of oil to 120 billion stb and from 290 trillion standard cubic feet (tscf) of natural gas to 297 tscf, reinforcing the country’s position as the custodian of the world’s sixth-largest oil reserves and the seventh-largest gas reserves.

ADNOC has recently made new oil and gas discoveries totaling more than 1.2 billion barrels of oil equivalent (boe). The discoveries were enabled by the deployment of industry-leading technologies including the world’s largest three-dimensional (3D) seismic survey and the application of AI-powered data interpretation that has unlocked previously inaccessible structures and formations, ADNOC said in a statement.

The Board also reviewed progress in unlocking Abu Dhabi’s unconventional resources to support domestic gas self-sufficiency and meet growing global demand for gas. The Board acknowledged ADNOC’s success in attracting new international partners to unconventional exploration concessions, bringing global expertise to accelerate development. Abu Dhabi’s unconventional recoverable resources are estimated at 160 tscf of gas and 22 billion stb of oil, according to ADNOC.

Saudi Aramco Signs Major Deals

At the end of 2025, Saudi state oil giant Aramco announced several major agreements and breakthroughs.

Aramco signed in November as many as 17 Memoranda of Understanding (MoUs) and agreements with a potential total value of more than $30 billion with major companies in the US. The potential agreements are expected to support Aramco’s strategic growth objectives while enhancing shareholder value, and involve collaborations and partnerships covering a range of activities including LNG, financial services, advanced materials manufacturing, and procurement of materials and services.

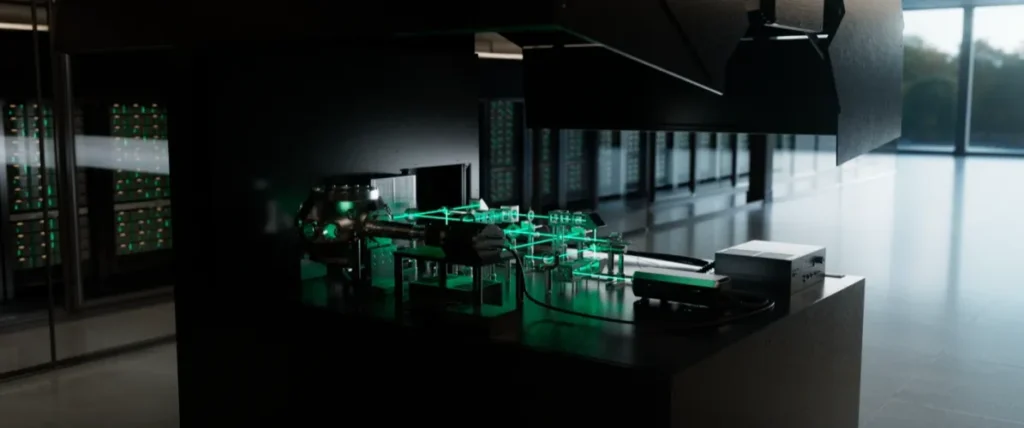

Furthermore, Aramco, in partnership with neutral-atom quantum computing firm Pasqal, said they had successfully deployed Saudi Arabia’s first quantum computer, and the region’s first quantum computer dedicated to industrial applications.

The deployment of Pasqal’s quantum computer powered by neutral-atom technology at Aramco’s data center, in Dhahran, marks a pivotal step in building regional expertise and accelerating the development of quantum applications across the energy, materials, and industrial sectors in the Saudi Arabia and the broader Middle East, Aramco said.

“We are deploying AI and other technologies at scale to further enhance our operations, maximize efficiency and unlock value across our business,” said Ahmad Al-Khowaiter, Aramco EVP of Technology & Innovation.

“Our partnership with Pasqal is a natural progression and we are thrilled to pioneer next-generation quantum capabilities, harnessing significant opportunities presented by this new frontier in computing.”

Aramco, ExxonMobil, and Samref have signed a Venture Framework Agreement to evaluate a significant upgrade of the Samref refinery in Saudi Arabia, and an expansion of the facility into an integrated petrochemical complex.

The three companies will explore capital investments to upgrade and diversify production, including high-quality distillates, as well as opportunities to improve the refinery’s energy efficiency and reduce emissions from operations through an integrated emissions-reduction strategy.

“Designed to increase the conversion of crude oil and petroleum liquids into high-value chemicals, this project reinforces our commitment to advancing Downstream value creation and our liquids-to-chemicals strategy,” Aramco Downstream President, Mohammed Al Qahtani, said in December.