Shares in Shetland oil pioneer surge after £150m takeover bid

West of Shetland oil pioneer Hurricane Energy has seen its shares surge around 12 per cent after revealing it has received a £150 million takeover offer amid the surge in crude prices fuelled by the war in Ukraine.

Hurricane said it had received an unsolicited cash offer from a bidder that it did not name, which follows a dramatic improvement in the company’s fortunes.

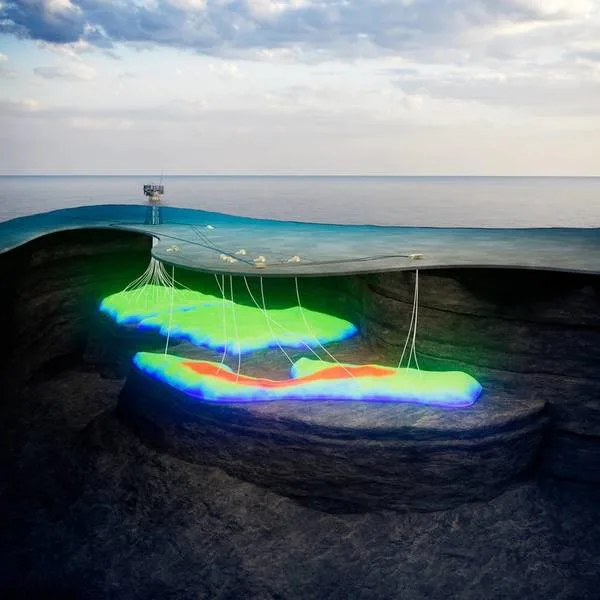

Hurricane stoked huge interest in the West of Shetland basin after making promising finds in an area that bigger fish had overlooked.

The company saw its valuation top £1 billion after it started production from the flagship Lancaster field in 2019.

Shares in the firm plunged after it faced production setbacks on Lancaster and demand for crude slumped as a result of the pandemic sending it deep into the red.

However, after creditors looked set to take control of the firm last year, Hurricane has seen its revenues surge following the rise in oil prices that followed the easing of lockdown measures and which gained impetus after Russia launched its attack on Ukraine.

News of the approach to Hurricane provides a further sign that investors see value in North Sea assets despite the prospect of tax increases in the area.

Prime Minister Rishi Sunak is facing calls to increase the windfall tax on North Sea profits that he introduced while serving as Chancellor in the administration led by Boris Johnson

With Hurricane generating huge amounts of cash from the Lancaster field directors are confident that the London-listed company has a bright future as an independent.

Complaining that the 7.7p per share indicative offer made by the unnamed bidder concerned was pitched at a premium of only 13 per cent to Hurricane’s closing share price on Monday, directors said they could not recommend it to shareholders.

However, they have launched a formal sale process for the company to see if a bidder would be prepared to make an offer at what they think is an appropriate valuation.

If the process does not result in a deal directors said shareholders would be in line for payouts totalling up to $70m early next year. Further payouts could follow.

The company’s chairman Philip Wolfe said: “The Board intends to deliver near term shareholder returns through either the successful outcome of the formal sale process or with a substantial capital return programme. Hurricane is in a strong position with an experienced senior team, robust balance sheet, profitable ongoing production and significant tax losses.”

Hurricane is facing a complication as a result of the fact that the biggest shareholder in the firm, Crystal Amber Fund, has indicated to the board that it wants to “monetise” the value of its 28.9% holding.

Crystal Amber Fund previously led opposition to a restructuring plan proposed by former directors that would have resulted in creditors taking control of Hurricane. The High Court blocked the plan in June last year after deciding that Hurricane should wait to see if the outlook improved.

Hurricane shares closed up 0.8p at 7.6p yesterday. They sold for 60p in June 2019 after Hurricane started production from Lancaster but fell to a low of 0.66p in May last year.

Geologist Robert Trice founded Hurricane to focus on an area of granite called the fractured basement. Scottish Gas owner Centrica bought into Hurricane’s acreage in 2018.

Hurricane lost $625m in 2020 after cutting estimates of the size of finds it had made.

Mr Trice resigned as chief executive in June 2020.

Hurricane made $67m profit in the first half of this year.

The Brent crude price fell below $20 per barrel in April 2020. Brent crude sold for around $95/bbl yesterday.

Published: 03-11-2022